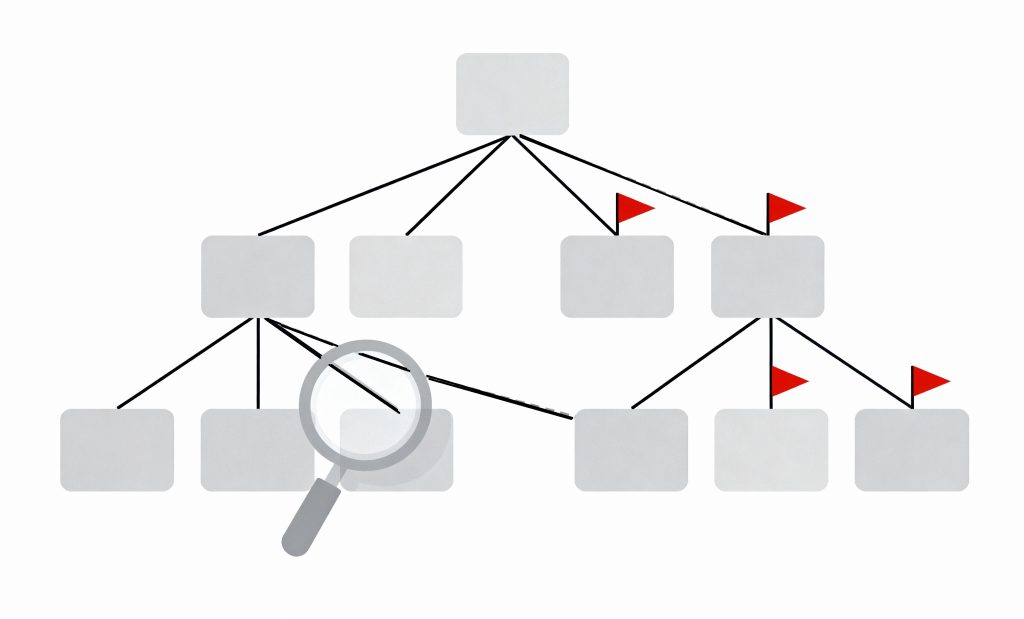

In the context of a complex worldwide financial system, being aware of red flags in ownership structures is essential to preventing sanctions evasion, money laundering, and other criminal financial activity.

Red flags in ownership structures may indicate a higher risk of financial crime or sanctions evasion. These include opaque or complex arrangements that obscure the Ultimate Beneficial Owner (UBO), frequent or unexplained ownership changes, use of shell companies without a legitimate purpose, exposure to high-risk jurisdictions or Politically Exposed Persons (PEPs), and deliberate efforts to avoid disclosure requirements or Customer Due Diligence (CDD).

Indicators of Hidden Ownership

- Complex and Opaque Structures: Very intricate chain of ownership or the use of multiple layers of companies without clear business rationale may indicate an attempt to disguise the true beneficial owners.

- Shell Companies: The use of paper-only companies that have no substantive operations, assets, or personnel, especially when combined with other red flags, is a strong indicator of probable illegal activity.

- Nominee Arrangements: A beneficial owner who appears to be a nominee (on behalf of someone else) or a company which is a nominee for some other party that remains undisclosed would warrant closer scrutiny.

- Reluctance to Provide Information: Refusal by a customer to provide complete beneficial ownership information or to proceed with the Customer Due Diligence (CDD) process would raise substantial red flags.

Risks Associated with Jurisdictions and Individuals

- High-Risk Jurisdictions: Handling individuals or entities in jurisdictions with high levels of corruption, close relationships with terrorism, or weak anti-money laundering (AML)/counter financing terrorism (CFT) regimes entail greater due diligence. This is particularly so in nations where government controls can impede access to vital information. For example, by experience, China directs information restrictions that prevent information sharing, and this can prove a major hindrance in due diligence processes.

- Politically Exposed Persons (PEPs): Politicians, public and government office members are usually associated with a higher risk of corruption and require strict vigilance, especially if they are associated with ownership structures.

- Negative Media: Bad news or reports concerning an individual or organisation committing illegal acts should increase your suspicion level and necessitate further investigation.

Other than ownership and geographic risk, behavioural transactional patterns such as how a company moves money can also provide significant red flags worth investigating.

Operational and Transactional Red Flags

- Inconsistent or Unusual Activity: Not consistent with a client’s normal business activity are transactions such as unusual movement of funds or sudden, unexplained expansion of business, which are suspicious.

- High Frequency Changes in Ownership: A high frequency of changes in records of ownership of companies can be a method of hiding the ultimate ownership of an entity.

- Circular Ownership: A pattern in which ownership structures involve circular relationship between multiple companies could be a signal for fraud activities. For instance, a pattern in which Company A owns Company B, Company B owns Company C, and Company C has an interest in Company A. The circular pattern is difficult to track the ultimate control.

- Unregulated intermediaries or cryptocurrencies: Use of unregulated intermediaries or cryptocurrencies such as wallet providers or digital asset exchanges with no regulation or licensing will facilitate anonymous and hard-to-trace transactions, thereby increasing the likelihood of illicit use.

- Structuring Transactions Below Reporting Thresholds: Structuring transactions intentionally just below the reporting thresholds of the regulators, also called “smurfing,” is an evasive manoeuvre that can be indicative of attempts to circumvent anti-money laundering controls.

Fictitious Case Study

Background:

One medium-sized bank was onboarding a new corporate client who claimed to be a Central Asian logistics company. The company supplied all the documents that were asked for, but it raised a sequence of subtle red flags during the due diligence process.

Red Flags Detected:

- Complex and Opaque Structure: The new corporate client was owned through four tiers of offshore entities in the United Arab Emirates (UAE), British Virgin Islands, and Belize. The bank’s compliance department struggled to identify a natural person as the UBO.

- Shell Company Indicators: Two of the parent companies had no employees, business history, or assets and were registered at virtual office addresses.

- Reluctance to Provide Ownership Information: When asked for further clarification, the company representatives cited “privacy concerns” and delayed submission of shareholder registers. They also attempted to bypass Customer Due Diligence (CDD) by citing a pre-existing relationship with a correspondent bank.

- Connections to High-Risk Jurisdictions: The company conducted the majority of its transactions through the use of accounts in weak-regulatory anti-money laundering (AML) jurisdictions, and its major trading counterparts were located in countries partially under international sanctions.

- Politically Exposed Person (PEP) Involvement: Through open-source research and negative media screening, the bank found out that one of its parent company’s shareholders was a relative of a top government official who was sanctioned by the U.S. for corruption.

Outcome:

The Financial Crime team at the bank reported the case, and onboarding was temporarily suspended. A suspicious activity report (SAR) was filed with the respective Financial Intelligence Unit (FIU). Additional investigation also verified that new corporate client was part of an extended network involved in sanctions evasion and procurement of dual-use material.

Lesson

This example shows how all these subtle red flags, each of which could potentially be harmless alone, can together indicate a high-risk ownership structure. Banks cannot rely too much on documentation but need to dig deeper whenever red flags are detected, especially where these involve complex ownership structures or associations with high-risk jurisdictions.

Conclusion

Organisations ought to include these red flags in their onboarding and ongoing monitoring processes. Appropriate training and good due diligence structures are essential for successfully spotting and mitigating these risks.

Failing to respond to these red flags leaves organisations at huge risk of legal, financial, and reputational damages. Legally, organisations can face penalties, enforcement action, or substantial fines from regulators for non-compliance with anti-money laundering (AML) and sanctions law. Financially, intentional or unintentional involvement in criminal activities such as money laundering or sanctions evasion can lead to losses, frozen assets, or costly investigations.

In addition to regulatory and financial impact, reputational damage can undermine stakeholder confidence, impact business partnerships, and threaten long-term survivability. Consequently, it is essential to possess robust due diligence measures and prudence not only to comply with regulation but to maintain organisational integrity and long-term survivability.

How Can Trustnet.Trade Help

Trustnet.Trade helps you close critical sanctions compliance gaps by going far beyond basic name screening. With instant KYB and UBO checks, real-time monitoring, and global sanctions screening including AMS and PEP, Trustnet.Trade helps you identify indirect ownership risks. Its automated alerts, visual ownership mapping, and compliance widgets give you continuous monitoring and transparency. Combined with risk-based questionnaires, and whistleblower modules, it keeps companies of any size up to date with evolving regulations, preventing reputational and financial risks from escalating into significant problems.